LTD claim reviewing MAY extend a limitation period.

An application by a long term disability insurer to dismiss a claim commenced by an insured on the basis that the claim was barred by the expiration of the limitation period. The application was dismissed and costs awarded to the plaintiff. In White v. Manufacturers Life Insurance Co. (c.o.b. Manulife), [2011] B.C.J. No. 2273, the plaintiff was insured for a long term disability benefits under a group policy issued by the defendant, Manulife Insurance. The plaintiff submitted an application for disability benefits on September 13, 2006. On July 12, 2007 Manulife advised the plaintiff that...

read more$550,000 punitive damages for Ontario employee.

An Ontario court came down hard on an employer that attempted to terminate an employee for cause without sufficient justification for doing so. The termination and the employer’s actions related to the termination resulted in a criminal trial and a chain of events that led to the destruction of the employee’s reputation, and, accordingly to the employee, his marriage. The trial judge initially awarded the employee $25,000 in punitive damages and aggravated damages of $75,000. The employee appealed the punitive damages award and a new trial was ordered. The trial judge then...

read more$50,000 punitive damages for refusing to pay a fire loss.

On August 17, 2011, the insureds successfully sued their insurer in the British Columbia Supreme Court for losses suffered in a fire, as well as aggravated and punitive damages for the insurer’s refusal to pay, in Sidhu v. Wawanesa Mutual Insurance Co. In the early hours of February 7, 2005, the Sidhu’s family home was damaged by a fire. The plaintiff, Hardip Sidhu, was in the master bedroom with his wife and infant son before the fire started. He asked them to leave shortly before he heard something hit the bedroom window. He got dressed and looked around. His wife also looked outside...

read moreManulife loses “want of prosecution” application.

On May 30, 2011, the BC Supreme Court decided that Manufacturers Life Insurance Company (“Manulife”), successor to the Aetna Life Insurance Co. of Canada (“Aetna”) was unsuccessful in its application for an order dismissing an applicant’s action for want of prosecution. The decision is reported at: Toor v Aetna Life Ins. Co., 2011 BCSC 691. In 1975 the applicant, Harbans Toor purchased a policy of long-term disability insurance from Excelsior Life and the policy was eventually acquired by Manulife. In the action, Mr. Toor claimed, among other things, for benefits under that...

read moreThe significant role of expert evidence.

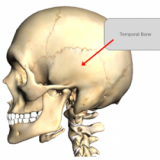

When presenting a claim at trial dealing with future loss it is vital to have appropriate expert evidence to justify sought damages. Failure to do so can result in a dismissal of the sought damages even if they are unopposed. Reasons for judgement released May 6, 2011 highlight the importance of medico-legal evidence in personal injury trials. In Moore v. Briggs the plaintiff suffered a fractured skull (fractured left temporal bone) and a brain injury in a 2003 assault. The plaintiff sued those he claimed were responsible for the assault. One of the defendant’s did not respond to the...

read moreInsurer’s failure to “follow up” may attract punitive damages.

On May 4, 2010, the Nova Scotia Court of Appeal held in Kings Mutual Insurance Co. v. Ackermann, that by not following up on all the evidence relevant to the claim, withholding critical information from the adjuster engaged to investigate the claim and allowing the adjuster to present the results of the investigation in a partisan, biased and un-objective manner, the insurer’s actions were such that an award of punitive damages was rationally required to punish the insurer’s conduct. The insureds were insured for damage to their dairy barn for the peril of a “windstorm”, among other...

read more