Legal Update

Bad Faith

Personal Injury

Insurance

Evidence

Most Recent Articles

$50,000 punitive damages for refusing to pay a fire loss.

On August 17, 2011, the insureds successfully sued their insurer in the British Columbia Supreme Court for losses suffered in a fire, as well as aggravated and punitive damages for the insurer’s refusal to pay, in Sidhu v. Wawanesa Mutual Insurance Co. In the early hours of February 7, 2005, the Sidhu’s family home was damaged by a fire. The plaintiff, Hardip Sidhu, was in the master bedroom with his wife and infant son before the fire started. He asked them to leave shortly before he heard something hit the bedroom window. He got...

read moreManulife loses “want of prosecution” application.

On May 30, 2011, the BC Supreme Court decided that Manufacturers Life Insurance Company (“Manulife”), successor to the Aetna Life Insurance Co. of Canada (“Aetna”) was unsuccessful in its application for an order dismissing an applicant’s action for want of prosecution. The decision is reported at: Toor v Aetna Life Ins. Co., 2011 BCSC 691. In 1975 the applicant, Harbans Toor purchased a policy of long-term disability insurance from Excelsior Life and the policy was eventually acquired by Manulife. In the action, Mr. Toor...

read moreThe significant role of expert evidence.

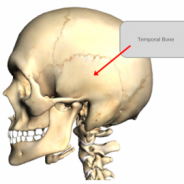

When presenting a claim at trial dealing with future loss it is vital to have appropriate expert evidence to justify sought damages. Failure to do so can result in a dismissal of the sought damages even if they are unopposed. Reasons for judgement released May 6, 2011 highlight the importance of medico-legal evidence in personal injury trials. In Moore v. Briggs the plaintiff suffered a fractured skull (fractured left temporal bone) and a brain injury in a 2003 assault. The plaintiff sued those he claimed were responsible for the assault....

read moreInsurer’s failure to “follow up” may attract punitive damages.

On May 4, 2010, the Nova Scotia Court of Appeal held in Kings Mutual Insurance Co. v. Ackermann, that by not following up on all the evidence relevant to the claim, withholding critical information from the adjuster engaged to investigate the claim and allowing the adjuster to present the results of the investigation in a partisan, biased and un-objective manner, the insurer’s actions were such that an award of punitive damages was rationally required to punish the insurer’s conduct. The insureds were insured for damage to their dairy barn...

read more$25,000 damages awarded for mental distress.

On September 28, 2009, the Ontario Superior Court of Justice released its decision in McQueen v. Echelon General Insurance Co., [2009] O.J. No. 3965. The Court made a substantial award of mental distress damages against the insurer, Echelon, for denial of benefits in the amount of $25,000.00. BACKGROUND This case arose from a claim for statutory accident benefits and damages for breach of the insurer’s duty to act in good faith. The plaintiff sustained injuries in a rollover motor vehicle accident. At the time of the accident, she was...

read moreManulife tried to avoid its own policy, and failed.

On August 17, 2009, The BC Supreme Court held that as between the limitation period in an insurance policy and the limitation period set out in Section 22(1) of the Insurance Act of British Columbia, the limitation period in the policy prevails so long as it is not shorter than that prescribed by Section 22(1). In Colgur v. Manufacturers Life Ins. Co., 2009 BCSC 1125, the insurance company, Manulife, applied for a dismissal of the Ms. Colgur’s claim for long-term disability . Ms. Colgur was employed by the Royal Bank...

read moreHorrific head-on collision nets trucker $320,000, including $75,000 for PTSD.

A BC Supreme Court judge awarded a plaintiff just over $320,000 in damages as a result of a serious BC Truck Accident. In Bonham v. Weir the plaintiff was driving a transport truck into Fort Nelson, BC, when another vehicle “crossed the centre line and collided head on with his truck. ” The plaintiff’s truck “burst into flames and (the Plaintiff) had to crawl out of the burning cab through a broken windshield.” ICBC admitted fault on behalf of the driver of the other vehicle leaving the court to deal only with an assessment of damages. Mr....

read moreAn exclusion clause is only valid if it is unambiguous.

On September 16, 2008 the Alberta Court of Appeal confirmed in Duke v. Clarica Life Insurance Co. 2008 ABCA 301 that an ambiguous term in a critical illness policy exclusion clause should be construed against the insurer. The insurance company had issued a critical illness policy to Mr. Duke. When Mr. Duke developed Parkinson’s disease, the insurance company denied his claim, relying on an exclusion clause which stated: “if the insured person had a covered critical illness or any symptoms associated with a covered critical illness...

read moreManulife found to be a “bully” and ordered to pay $250,000 punitive damages.

On December 14, 2007, the Ontario Court of Appeal upheld an order that The Manufacturers Life Insurance Company (“Manulife”) pay $250,000 in punitive damages.

read moreMental distress damages flow from a breach of the policy.

The Supreme Court of Canada set aside an award of punitive damages of $100,000 against a disability insurer (“Sun Life”), but upheld an award of $20,000 in aggravated damages for mental distress for breach of contract. Fidler worked as a bank receptionist and was covered by a group policy that included long-term disability benefits. At the age of 36, she became ill and was eventually diagnosed with chronic fatigue syndrome and fibromyalgia and began receiving long-term disability benefits in January 1991. Under the terms of the...

read more