Legal Update

Bad Faith

Personal Injury

Insurance

Evidence

Most Recent Articles

Supreme Court Judge: ICBC doctor a “very unhelpful medical witness”.

On December 23, 2015, the BC Supreme Court criticized a defence expert witness for crossing the line into advocacy. In Ferguson v. McLaughlin the plaintiff was injured in a 2009 collision caused by the defendant. The defendant’s insurer hired a physician who presented evidence largely discounting the connection of the plaintiff’s complaints to the collision. In rejecting this evidence Madam Justice Griffin made the following pointed comments: [63] The defendant called the...

read more$3 million award for brain injury.

On December 14, 2015, the BC Supreme Court assessed damages of $3 million dollars for a plaintiff who sustained a brain injury in a vehicle collision. In Grassick v. Swansburg the plaintiff, who was 16 at the time, was a pedestrian and struck by a vehicle driven by the defendant. The plaintiff suffered a moderate to severe brain injury which impacted his cognition and was expected to have permanent repercussions. The Court found that the plaintiff was an ambitious and hard working young man who, but for the brain injury, would...

read moreExpert did not meet with, examine or interview plaintiff = NO WEIGHT.

On November 30, 2015, the BC Supreme Court rejected the opinion of a defence retained doctor who “did not meet with, examine or interview” the plaintiff but nonetheless authored a report opining on the plaintiff’s injuries. In Preston v. Kontzamanis Mr. Justice Parrett provided the following critical comments for medico-legal practices: [125] The defendant provided and relied upon what purported to be an independent medical report (IME) by Dr. Boyle. [126] Dr. Boyle readily...

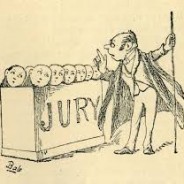

read moreJury can know about all defence medical examinations.

On November 27, 2015, the BC Supreme Court confirmed that it is fair game for plaintiffs to testify that they attended a defence medical exam where no report was produced and the defence is not relying on opinion evidence from their expert. In Norris v. Burgess the plaintiff alleged injury as a result of two collisions. The defendants denied any injury occurred. In the course of the lawsuit the plaintiff attended a defence medical appointment with a psychiatrist. The defendants “chose not to obtain a medical opinion from the psychiatrist”...

read more“Inconsistent” jury award requires a new trial.

On November 26, 2015, a judge of the BC Supreme Court ordered a retrial in a personal injury lawsuit after a jury awarded special damages but denied the plaintiff damages for his non-pecuniary loss. In Harder v. Poettcker , 2015 BCSC 2180, the plaintiff requested a jury trial after suffering injuries in a motor vehicle accident. The jury found the plaintiff 85% at fault for the crash and awarded a total $5,100 in damages (all based on out of pocket expenses) and then awarded nothing for non pecuniary damages. After applying the split of...

read moreInsured injured 2 days before end of waiting period denied coverage.

On November 20, 2015, the Manitoba Court of Queen’s Bench held that there was no coverage for insured who suffered injury two days prior to expiration of waiting period for coverage under group disability policy. In Funk v. Blue Cross Life Insurance Co., the insured sued his insurer with respect to a group disability insurance policy. The insured had started a new position as a truck driver. One of the benefits offered to him was a group health plan including disability insurance. In order to qualify for coverage one of the provisions...

read moreCourt of Appeal finds the insurer acted in bad faith.

On November 17, 2015, the Nova Scotia Court of Appeal upheld awards of both aggravated and punitive damages against a long-term disability insurer, but reduced the aggravated damages to $90,000, and reduced the punitive damages to $60,000, in Industrial Alliance v Brine, 2015 NSCA 104. On June 18, 2014, the Supreme Court of Nova Scotia held, at 2014 NSSC 219, that the long-term disability insurer Industrial Alliance Insurance and Financial Services Inc. (“Industrial”) must account for years of unfair treatment of its insured,...

read more$60,000 in damages for chronic back injury.

On November 16, 2015, the BC Supreme Court assessed damages for lingering injuries caused by two vehicle collisions. In Ali v. Rai, 2015 BCSC 2085, the plaintiff was involved in two collisions in 2011. He was found faultless for both. The collisions caused a lingering back injury which remained symptomatic at the tie of trial and the symptoms were expected. The Court found both collisions caused the injury and it was indivisible. In assessing non-pecuniary damages at $60,000 Madam Justice Duncan provided the following reasons: [134] On the...

read more$60,000 in damages for STI with headaches.

On November 10, 2015, the BC Supreme Court awarded non-pecuniary damages of $60,000 for chronic soft tissue injuries with associated headaches. In Hinder v. Yellow Cab Company Ltd., 2015 BCSC 2069, the plaintiff was involved in an intersection collision. The defendant denied liability but was found fully at fault at trail. The plaintiff suffered a variety of soft tissue injuries, some of which resolved. She continued to have neck symptoms with associated headaches at the time of trial (some five years later) which were expected to linger into...

read moreRequest for photos of plaintiff’s dancing dismissed.

On November 2, 2015, the BC Supreme Court dismissed a request for a plaintiff to produce various photographs. In Wilder v. Munro the plaintiff was injured in a 2010 collision and sued for damages. In the course of the lawsuit ICBC reviewed the plaintiff’s social media accounts and obtained: “ten separate videos of the plaintiff dancing in rehearsals or shows in 2013, 2014 and 2015, photographs of the plaintiff performing dance moves, Facebook status posts discussing upcoming dance shows and auditions in 2011, photographs and posts...

read more