Legal Update

Bad Faith

Personal Injury

Insurance

Evidence

Most Recent Articles

Insuring both tortfeasor and victim creates conflict.

On April 24, 2015, a 3-judge panel of the Ontario Superior Court of Justice – Divisional Court, held that where an insurer insures both the tortfeasor for liability coverage and the victim for accident benefits, the insurer should set up a firewall so that information gathered by it regarding the accident benefits claim is not available in the tort action. In Dervisholli v. Cervenak the plaintiff insured was involved in a motor vehicle collision. The insurer insured both the plaintiff’s vehicle and the defendant’s vehicle under...

read moreManulife tried to use maternity leave to reduce bonus, and lost.

On April 22, 2015, the Supreme Court of British Columbia ordered Manulife to pay damages of over $140,000 to a recruiter of financial advisors in a wrongful dismissal suit. The decision is noteworthy in that the court refused to allow Manulife to use its employee’s maternity leave as a reason to reduce her bonus payment. In Sowden v. Manulife Canada Ltd., the court ruled that Manulife owes damages to former employee Janice Sowden after she was dismissed in a “corporate restructuring”. In an earlier decision the court ruled, after...

read moreThe “Standard of Proof” does not change for subjective injuries.

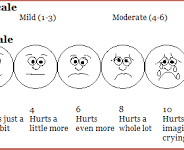

On April 16, 2015, the BC Supreme Court confirmed that the standard of proof does not change for a tort claim based on subjective soft tissue injuries. In Rabiee v. Rendleman, 2015 BCSC 595, the plaintiff was involved in a 2008 rear end collision. The defendant admitted fault but disputed injury pointing in part to the fact that the collision was minor. In accepting the plaintiff sustained soft tissue injuries and assessing non-pecuniary damages at $40,000 Madam Justice Sharma provided the following comments about the standard of proof in low...

read more$100,000 for soft tissue injuries with psychological aspect.

On April 1, 2015, a judge of the BC Supreme Court assessed damages for a chronic pain condition stemming from collision related soft tissue injuries. In Karim v. Li the plaintiff was injured in a 2011 collision. The defendant accepted fault for the crash. The plaintiff suffered various soft tissue injuries which, coupled with psychological consequences, resulted in an ongoing chronic pain condition. In assessing non-pecuniary damages at $100,000 Mr. Justice Abrioux provided the following reasons: (a) prior to the Accident, Mr. Karim was a...

read moreYoung child need not be examined for discovery.

On March 12, 2015, a judge of the BC Supreme Court dismissed a defense application to conduct an examination for discovery of an 8 year old plaintiff in a motor vehicle accident lawsuit. In Dann-Mills v. Tessier, 2015 BCSC 386, the plaintiff was injured involved in a serious motor vehicle accident when he was 17 months old, allegedly suffering a serious traumatic brain injury. A lawsuit was brought on his behalf by a litigation guardian. The defendants sought a court order compelling the child to undergo an examination for discovery. The...

read moreLife insurance claim denied for misrepresentations.

On March 3, 2015, the Nova Scotia Court of Appeal upheld the denial of a widow’s application for life insurance benefits following the death of her husband, the insured, because the insured had materially misrepresented his medical history in his application for life and disability insurance. In Linden Estate v. CUMIS Life Insurance Co., an insured applied for life and disability insurance. The application included a supplementary health questionnaire to be completed over the telephone. The questionnaire included questions...

read moreConsultation reports are not “expert reports”.

On February 3, 2015, the BC Court of Appeal released Reasons criticizing and restricting the practice of shoehorning physicians consultation reports into evidence as expert opinion. In Healey v. Chung the plaintiff was injured in a 2005 pedestrian/vehicle collision. At trial the plaintiff claimed it was a ‘catastrophic accident’ and sought damages between $485,000 and $1,037,000. The trial judge rejected much of the plaintiff’s evidence and awarded damages of just over $50,000. In the course of the trial the defendant introduced...

read more$120,000 for chronic pain, PTSD and depression.

In Luis v. Marchiori, 2015 BCSC 1, the plaintiff was involved in two collisions, the first in 2008 and the second in 2011. ICBC admitted fault for both defendants. The plaintiff sustained chronic injuries and in valuing non-pecuniary damages at $120,000 Madam Justice Gray provided the following reasons: [178] I would summarize the significant factors as follows: a) Ms. Luis is 49 years old; b) In the accidents, Ms. Luis suffered predominantly soft-tissue injuries which have led to painful shoulder surgery, chronic disabling pain in her neck...

read moreParties to a contract must be honest with each other.

In Bhasin v. Hrynew, 2014 SCC 71, the Supreme Court clearly stated that there is a duty to be honest in the performance of a contract. Mr. Bhasin, started an action after his relationship with Canadian American Financial Corp. (“Can-Am”) soured. Ultimately, Can-Am refused to renew the dealership agreement it had with Mr. Bhasin. Mr. Bhasin had acted as an enrollment director for Can-Am, which was in the business of marking education savings plans to investors (“ESPs”). Like all other enrollment directors...

read moreOrthopaedic exams have little value in chronic pain cases.

One of the more frustrating aspects of practicing in disability benefits law that that insurance companies repeatedly send claimants who have soft tissue, chronic pain injuries to orthopedic surgeons for “independent” medical examinations to determine their eligibility for certain benefits or the reasonableness of treatment plans. They are requested to perform these assessments even though they are typically outside their area of expertise. More often than not, the assessment finds “no objective evidence on ongoing impairment”,...

read more