Legal Update

Bad Faith

Personal Injury

Insurance

Evidence

Most Recent Articles

Worsening prognosis not enough to allow late DME.

On August 7, 2015, a master of the BC Supreme Court ruled that a plaintiff’s failure to recover from injuries is not enough for a defendant to secure a late defence medical exam. In Dzumhur v. Davoody, 2015 BCSC 1656, the plaintiff was injured in a a collision and sued for damages. In the course of the lawsuit the plaintiff served an expert report opining that the plaintiff ought to recover provided the injuries are responsive to recommended treatments. The defendant did not obtain a defence medical report and as the deadline approached for...

read moreSimple assertion of contemplated litigation doesn’t cut it.

On August 6, 2015, the BC Supreme Court effectively dismantled an ICBC claim for litigation privilege in Buettner v. Gatto. The plaintiff in that case was injured in a collision and advanced a claim for damages. The plaintiff retained counsel. Liability was initially admitted and then denied by ICBC. The plaintiff brought an application for production of various relevant documents and ICBC refused disclosure on the grounds that litigation was reasonably contemplated once the plaintiff retained counsel. The Court rejected this finding this...

read more$67,500 for chronic soft tissue injuries and depression.

In Dhanji v. Holland, 2015 BCSC 1351, the plaintiff pedestrian was struck in a marked cross walk by a vehicle driven by the defendant. The defendant admitted fault for the collision. The plaintiff suffered a variety of soft tissue injuries, some of which were chronic in nature and developed depression secondary to this. In assessing non-pecuniary damages at $67,500 (a figure which was arrived at following a 10% deduction in damages for the plaintiff’s failure to mitigate damages by refusing to attend recommended counselling) Mr. Justice...

read moreBad faith claim leads to broad disclosure obligations.

Shirley Wade suffered injuries as a result of a motor vehicle accident in 2005. In 2008, her insurer, the Wawanesa Mutual Insurance Company, stopped paying her disability benefits. Wade started a lawsuit for breach of contract and bad faith against Wawanesa. During the discovery of Wawanesa’s representative on the bad faith claim, counsel for Wawanesa refused four requests for information, as follows: 1. During the 5 years before Wawanesa terminated Wade’s benefits, provide the number of policy holders who received income replacement...

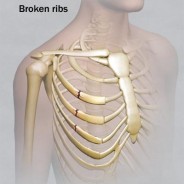

read more$110,000 for fractured fibs, knee injury and chronic pain.

In Grewal v. Naumann, 2015 BCSC 1147, the plaintiff was involved in a 2007 T Bone collision. The collision was significant and resulted in 3 broken ribs, a knee injury requiring surgical intervention and a variety of soft tissue injuries resulting in some chronic symptoms. In assessing non-pecuniary damages at $110,000 Mr. Justice Masuhara provided the following reasons: [120] My findings of the injuries suffered by the plaintiff from the Accident are: (a) three fractured ribs two of which were comminuted, and internal injuries which...

read moreInsurer has no duty to investigate, says Court.

On June 30, 2015, the Nova Scotia Supreme Court held that an insurer has no duty to investigate the information provided by the insured to unearth misrepresentations by the insured. A broker was held liable for failing to make inquiries into whether an insured’s representative who completed the insurance applications had the necessary training or experience to do so and if not to discuss the benefits of property inspections with him. The insured was apportioned 50% liability for failing to ensure that its representatives handling...

read moreAppeal Court reduces punitive damages for bad faith.

On June 19, 2015, the Saskatchewan Court of Appeal reduced awards of extra-contractual damages made on March 21, 2013. The trial decision of a Justice of the Saskatchewan Court of Queen’s Bench assessed punitive damages totalling $5,000,000 against two insurers in a recent trial decision, Branco v. American Home Assurance et. al., 2013 SKQB 98. In rendering a decision in which he found the insurers’ treatment of the insured to be “calculated and abhorrent”, Justice Acton sent a message to all insurers doing business in Canada: “It is hoped...

read more$75,000 For chronic back pain.

In Renaerts v. Renaerts, 2015 BCSC 1028, a 24 year old plaintiff was injured as a passenger in a 2009 collision. She sustained a variety of injuries that made a quick recovery but also sustained a back injury which remained symptomatic to the time of trial and had a generally guarded prognosis. In assessing non-pecuniary damages at $75,000 Mr. Justice Brown provided the following reasons: [215] Given accepted evidence as a whole, I agree with Mr. Shew that rehabilitation should focus on healthy activity, core strengthening, and a guided...

read moreJudge: ICBC’s expert “careless” if not “deceptive”.

In Hendry v. Ellis, 2015 BCSC 1186, the plaintiff was injured in a collision and sued for damages. The defendant’s insurer retained a doctor who minimized the connection between the plaintiff’s complaints and the collision. At trial, through cross examination, the doctor made various admissions beyond the borders of the opinion contained in the report. In criticizing the physician’s opinion as “careless” if not outright “deceptive” Mr. Justice Jenkins provided the following reasons: [26] Expert evidence tendered at trial was that the...

read more$150,000 for bilateral wrist and femur fracture.

On June 2, 2015, the BC Supreme Court assessed damages for bilateral wrist fractures leading to permanent partial dysfunction and a femur fracture. In Ishii v. Wong the plaintiff was involved in a 2012 motorcycle collision caused by the defendant. He sustained fractures to both wrists, and his right femur. These injuries requires surgical intervention including the installation of hardware in both wrists and his right leg. His dominant wrist did not fully heal and was left with permanent dysfunction. In assessing non-pecuniary damages at...

read more